Key takeaways:

- Global bonds diversify client portfolios and can enhance yield without increasing credit or duration risk.

- Active managers can explore this broader opportunity set to discover better relative value across a range of factors.

- Key performance drivers include the premia in foreign currency bonds, geographic diversification, the variety of bonds on the international market, and currency hedging strategies.

Advisors can improve yields and diversification of their fixed income portfolios by choosing products that supplement core bond holdings with international bonds.

Even better: These benefits can be achieved while buying similarly rated bonds and without adding duration risk.

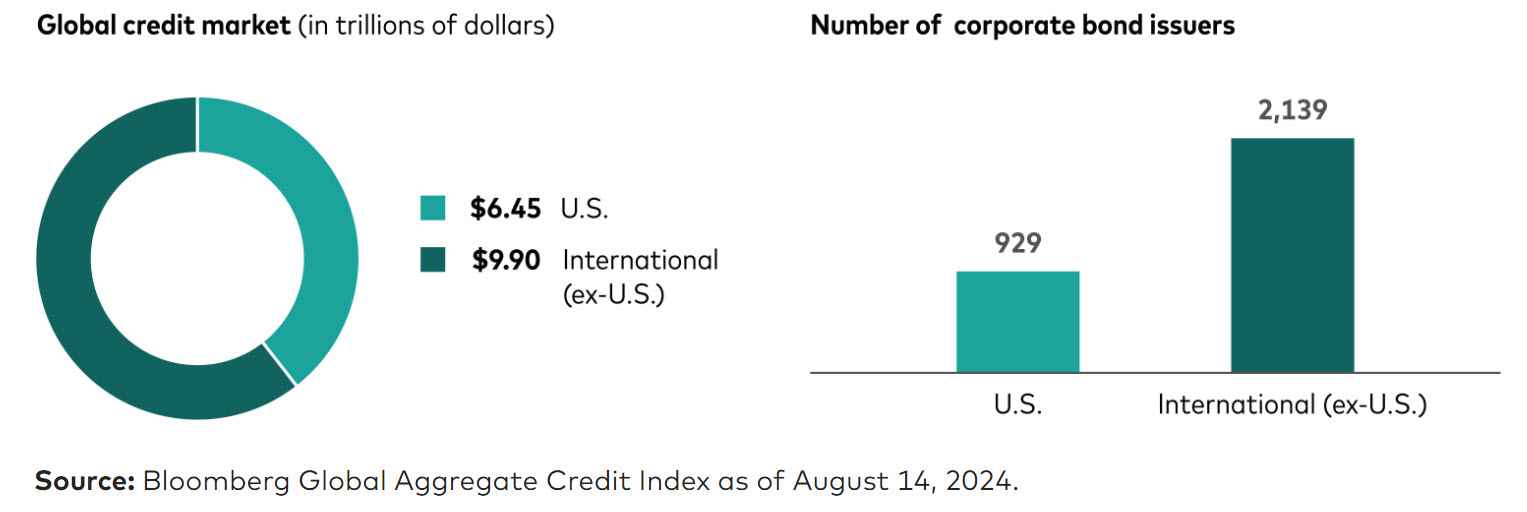

Vanguard’s global active fixed income team aims to take advantage of the $140 trillion global marketplace every day. Allocating to global bonds provides potential diversification benefits through exposure to additional inflation risk factors, economic environments, and market cycles, as well as market, sector, and credit risk premiums.1

We find these four factors to be key to driving active outperformance:

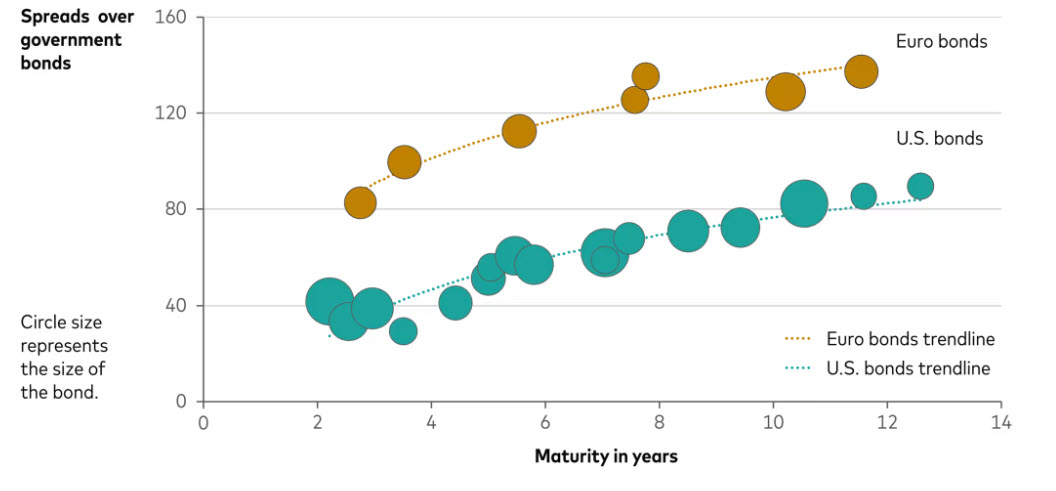

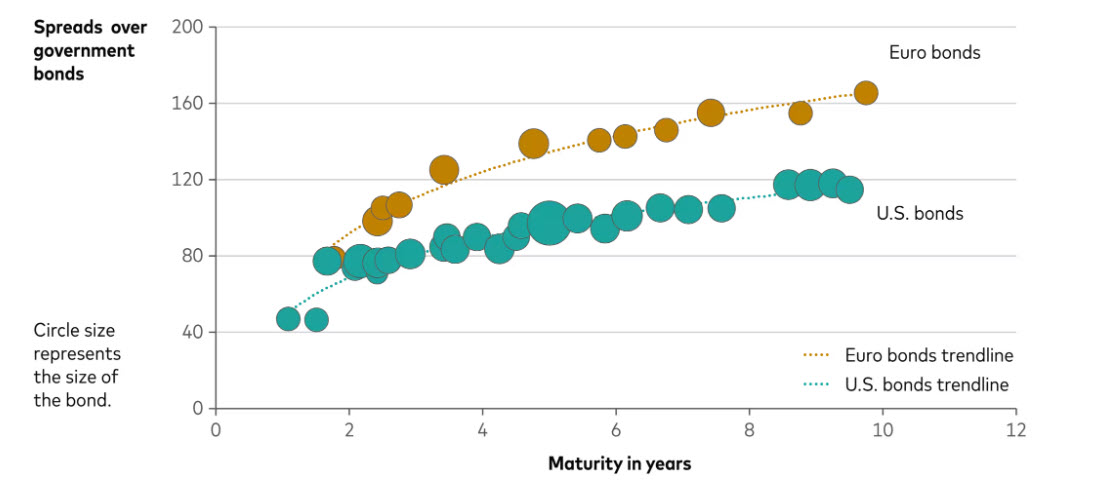

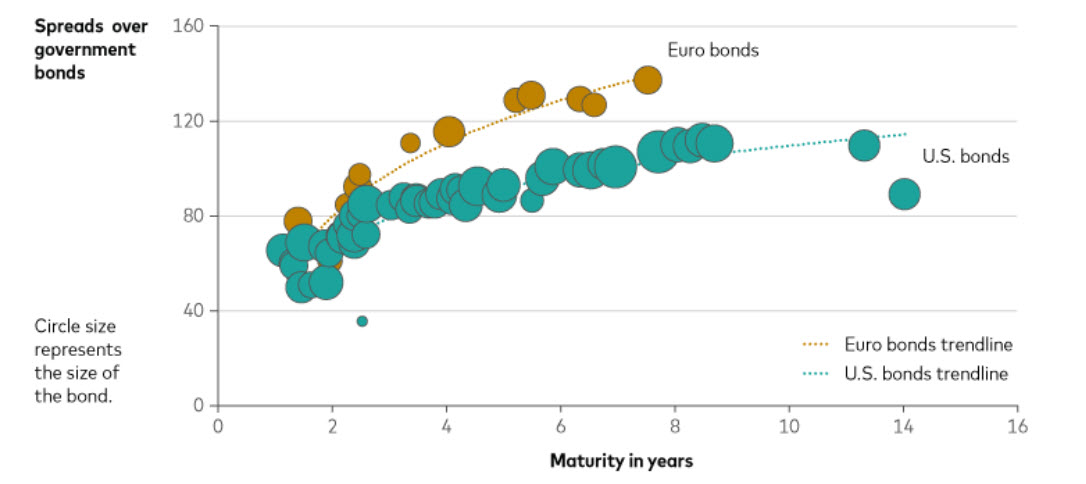

Foreign premium

U.S. investors pay more for bonds from familiar companies, while they tend to expect a higher premium (spread2 ) from unfamiliar names. This dynamic often results in European companies facing higher spreads when issuing bonds in U.S. dollars (USD); similarly, U.S. companies issuing bonds in euros pay a premium, despite equally strong credit profiles.

- For example, as the graphs below show, bonds issued in euros for Honeywell, American Tower, and J.P. Morgan all offer higher spreads over government bonds versus the bonds from the same issuers in USD. This, in turn, can result in higher yields when these foreign currency bonds are hedged back to USD.

Bond spreads higher for euro-denominated issues

Honeywell

American Tower

J.P. Morgan

Source: Vanguard CreditRover as of August 14, 2024.

Geographical diversification

Changing geopolitical environments, regulatory frameworks, demographics, and monetary and fiscal policies further exacerbate performance disparities between bonds issued in different countries. Among corporate bonds, sector- and company-level factors can also produce premia.

- Bonds issued by companies with improving credit profiles and attractive valuations tend to perform best and present an opportunity for active managers. For example, regional banks in Europe are experiencing an upgrade cycle, while U.S. regional banks are challenged by the slide in commercial real estate.

- Southwest in the U.S. and easyJet in Europe are both regional airlines rated BBB by S&P. Yet, easyJet bonds trade with a higher spread, providing another example of the benefits of going global to pick up income without changing the quality of your investments.

Exposure to new instruments

Regulations in different regions can drive financial innovation. Global markets have developed new types of corporate bonds, and the markets for these instruments tend to be deeper and more liquid outside the U.S. Choosing the right part of the capital structure can help deliver better results.

- European banking regulations offer exposure to different parts of the capital structure, such as senior non-preferred bonds, which sit in the middle of bank financing seniority. Hence, they tend to offer higher yields for the same underlying credit risk.

- For example, bonds issued by BNP Paribas, a large French investment bank, include senior non-preferred. Those rank behind senior preferred bonds and above subordinated debt in the credit system. European utilities also have subordinated debt in the form of hybrids that offer higher yields.

Capital structure for BNP Paribas bonds

Source: Vanguard CreditRover as of August 14, 2024.

Currency hedges

Currency hedges can protect portfolio returns from foreign currency volatility and stabilize yields across countries. While differences may vary by country, small gains in a larger portfolio can add up significantly.

- For example, a one-year Japanese government bond that yields 0.2% in Japanese yen, would yield the equivalent of 4.7% when hedged to USD, 0.2% more than a 1-year Treasury bond3

Active managers can leverage these and other factors and adjust based on changing market conditions. Has the currency exchange rate changed? Perhaps the premium for ex-U.S. bonds is lower than we believe to be fair value, so we may decide to wait to buy a particular bond or set of bonds.

Spread-widening because of country-specific concerns may present an opportunity for better risk compensation, prompting a potential buy. Our expert teams around the world are well positioned to find the best prospects for our funds.

The market is always changing. It is our job as active managers to ferret out what we believe are the best choices. We believe successful active management over time is not about leveraging large macro bets, but consistently finding value, sometimes in small differences. As advisors, it is your job to decide which of your clients can benefit from exposure to global bonds and choose the products that can fully leverage those opportunities.

1 Harvey, Oliver and Giulio Renzi-Ricci, Going global with bonds: The benefits of a more global fixed income allocation, Valley Forge, Pa., 2023.

2 Difference between the yield of a corporate bond and the equivalent government bond in the same currency of issue.

3 Source: Bloomberg Terminal, YAS function as of August 14, 2024.

| Fund name | Expected range of portfolio allocated to ex-U.S. bonds | Strategy | Domicile | Ticker | Fee | # of securities |

|---|---|---|---|---|---|---|

| Vanguard Global Aggregate Bond ETF- USD hedged Accumulating | 35 – 55% | Passive | UCITS | VAGU | 0.10% | >17,000 |

| Vanguard Total World Bond ETF - USD hedged | 40 – 60% | Passive | US | BNDW | 0.05% | >17,000 |

| Vanguard Total International Bond ETF | 100% | Passive | US | BNDX | 0.07% | >6,000 |

Note: Ex-U.S. bonds include those issued in non-U.S. dollar currencies by U.S. issuers and bonds issued in U.S. dollars by non-U.S. issuers.

For more information about Vanguard funds or Vanguard ETFs, visit advisors.vanguard.com or call 800-997-2798 to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information about a fund are contained in the prospectus; read and consider it carefully before investing.

Vanguard ETF Shares are not redeemable with the issuing Fund other than in very large aggregations worth millions of dollars. Instead, investors must buy and sell Vanguard ETF Shares in the secondary market and hold those shares in a brokerage account. In doing so, the investor may incur brokerage commissions and may pay more than net asset value when buying and receive less than net asset value when selling.

Vanguard Core Bond ETF and Vanguard Core-Plus Bond ETF are not to be confused with the similarly named Vanguard Core Bond Fund and Vanguard Core-Plus Bond Fund. These products are independent of one another. Differences in scale, certain investment processes, and underlying holdings between the ETFs and their mutual fund counterparts are expected to produce different investment returns by the products.

All investing is subject to risk, including possible loss of principal. Diversification does not ensure a profit or protect against a loss.

Bond funds are subject to interest rate risk, which is the chance bond prices overall will decline because of rising interest rates, and credit risk, which is the chance a bond issuer will fail to pay interest and principal in a timely manner or that negative perceptions of the issuer’s ability to make such payments will cause the price of that bond to decline.

Investments in bonds issued by non-U.S. companies are subject to risks including country/regional risk, which is the chance that political upheaval, financial troubles, or natural disasters will adversely affect the value of securities issued by companies in foreign countries or regions; and currency risk, which is the chance that the value of a foreign investment, measured in U.S. dollars, will decrease because of unfavorable changes in currency exchange rates.

Bloomberg® and Bloomberg Indexes mentioned herein are service marks of Bloomberg Finance LP and its affiliates, including Bloomberg Index Services Limited (“BISL”), the administrator of the index (collectively, “Bloomberg”) and have been licensed for use for certain purposes by Vanguard. Bloomberg is not affiliated with Vanguard and Bloomberg does not approve, endorse, review, or recommend the Financial Products included in this document. Bloomberg does not guarantee the timeliness, accurateness or completeness of any data or information related to the Financial Products included in this document.

Vanguard Mexico is not responsible for and does not prepare, edit, or endorse the content, advertising, products, or other materials on or available from any website owned or operated by a third party that may be linked to this email/document via hyperlink. The fact that Vanguard Mexico has provided a link to a third party's website does not constitute an implicit or explicit endorsement, authorization, sponsorship, or affiliation by Vanguard with respect to such website, its content, its owners, providers, or services. You shall use any such third-party content at your own risk and Vanguard Mexico is not liable for any loss or damage that you may suffer by using third party websites or any content, advertising, products, or other materials in connection therewith.